One Analyst’s Earnings Estimates For Green Landscaping Group AB (publ) (STO:GREEN) Are Surging Higher

Shareholders in Green Landscaping Group AB (publ) (STO:GREEN) may be thrilled to learn that the covering analyst has just delivered a major upgrade to their near-term forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with the analyst modelling a real improvement in business performance.

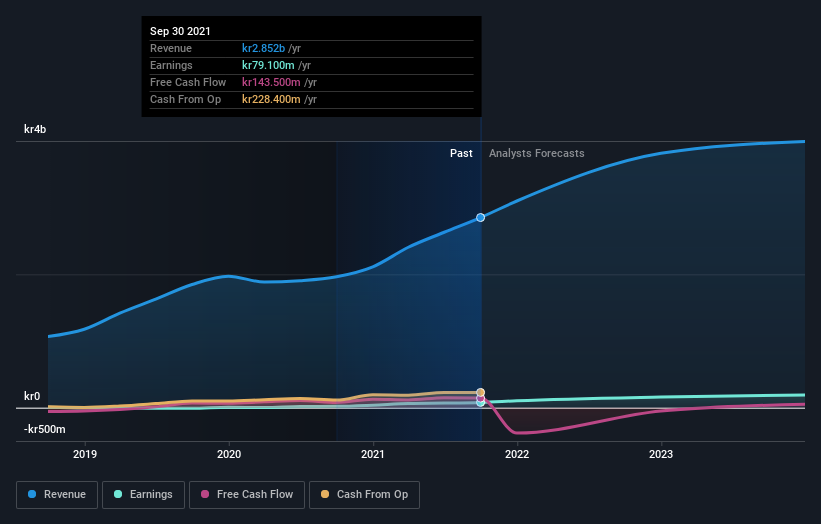

Following the upgrade, the latest consensus from Green Landscaping Group’s solo analyst is for revenues of kr3.8b in 2022, which would reflect a substantial 34{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} improvement in sales compared to the last 12 months. Per-share earnings are expected to shoot up 96{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} to kr2.95. Previously, the analyst had been modelling revenues of kr3.3b and earnings per share (EPS) of kr2.52 in 2022. There has definitely been an improvement in perception recently, with the analyst substantially increasing both their earnings and revenue estimates.

Check out our latest analysis for Green Landscaping Group

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The period to the end of 2022 brings more of the same, according to the analyst, with revenue forecast to display 26{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} growth on an annualised basis. That is in line with its 28{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 6.9{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} per year. So it’s pretty clear that Green Landscaping Group is forecast to grow substantially faster than its industry.

The Bottom Line

The most important thing to take away from this upgrade is that the analyst upgraded their earnings per share estimates for next year, expecting improving business conditions. They also upgraded their revenue estimates for next year, and sales are expected to grow faster than the wider market. The clear improvement in sentiment should be enough to get most shareholders feeling more optimistic about Green Landscaping Group’s future.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have analyst estimates for Green Landscaping Group going out as far as 2023, and you can see them free on our platform here.

We also provide an overview of the Green Landscaping Group Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.