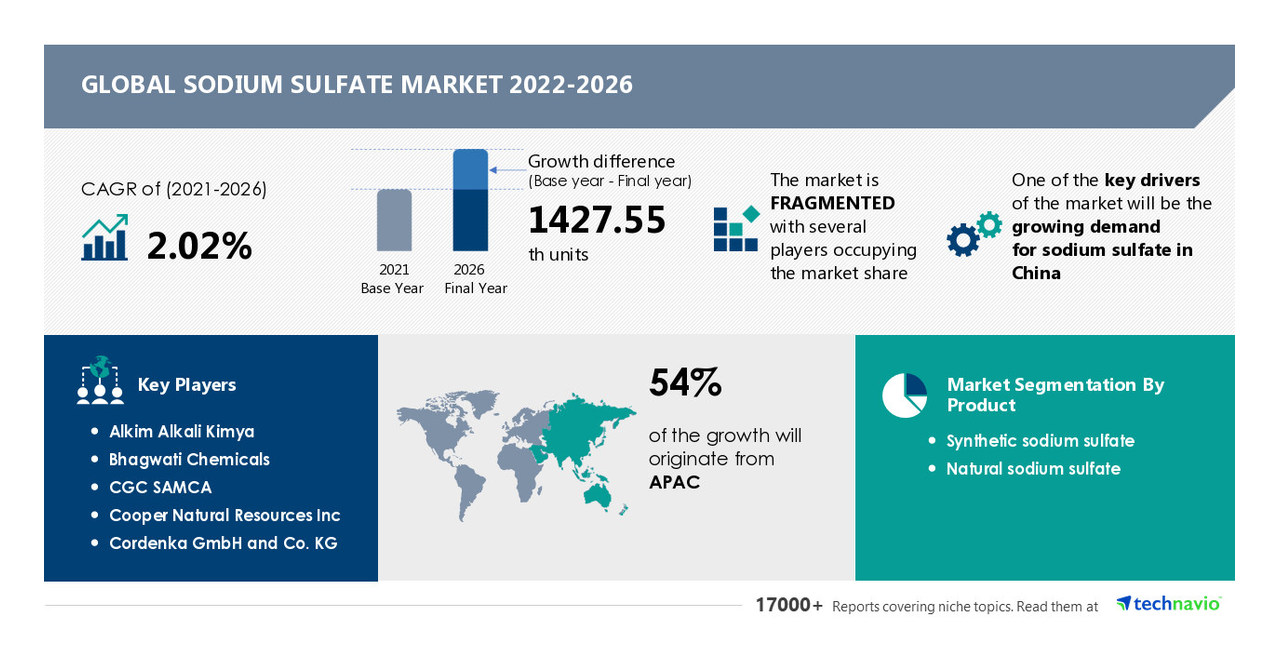

Sodium Sulfate Market Size to Grow by 1427.55 thousand units| 54{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} of the growth to originate from APAC| Technavio

- Product – Synthetic sodium sulfate and natural sodium sulfate

- Application – Detergent, glass, pulp and paper, and others

- Geography – APAC, Europe, North America, MEA, and South America

For more insights on YOY and CAGR, Read our latest Sample Report

Vendor Insights

The Sodium Sulfate Market is fragmented and the vendors are deploying various organic and inorganic growth strategies to compete in the market.

The growing competition in the market is compelling vendors to adopt various growth strategies such as promotional activities and spending on advertisements to improve the visibility of their services. Some vendors are also adopting inorganic growth strategies such as M&As to remain competitive in the market.

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Akamai Technologies Inc.

- Appgate

- Broadcom Inc.

- CERTES NETWORKS INC.

- Check Point Software Technologies Ltd.

- Cyxtera Technologies Inc.

- Dell Technologies Inc.

- DH2i Co.

- Fortinet Inc.

- Illumio Inc.

- Intel Corp.

- Ivanti Inc.

- Juniper Networks Inc.

- Okta Inc.

- Palo Alto Networks Inc.

- Perimeter 81 Ltd.

- Safe-T

- Verizon Communications Inc.

- Cato Networks Ltd.

- Cisco Systems Inc.

Find additional highlights on the growth strategies adopted by vendors and their product offerings, Read our Sample Report.

Geographical Market Analysis

APAC will account for 54 percent of market growth. The sodium sulphate market in APAC is dominated by China, Japan, and Mexico. The market in this region will increase at a quicker rate than the market in other regions.

Sodium sulphate market expansion in APAC would be aided by increase in the construction and textile sectors over the forecast period.

Furthermore, countries such as China, US, Spain, Russian Federation, Japan, and Mexico are expected to emerge as prominent markets for the Sodium Sulfate Market during the forecast period.

Know more about this market’s geographical distribution along with a detailed analysis of the top regions. Download Detailed Sample Report.

Key Segment Analysis

The synthetic sodium sulphate sector will gain a considerable proportion of the sodium sulphate market. Sodium sulphate is a low-cost, essential ingredient in the production of powder detergents. It’s a material with a neutral pH that dissolves easily in warm water. It functions as a desiccant. Sodium sulphate prevents clump formation in powder detergents by attaching to numerous molecules of water to produce hydrates.

Furthermore, as people’s awareness of health and hygiene has grown, powder detergents have become more widely used around the world. The need for detergents is being driven by a growing population in emerging countries like India and China, as well as an increased awareness of hygiene.

View Sample Report: to know additional highlights and key points on various market segments and their impact in coming years.

Product News and Insights

Alkim Alkali Kimya – Under the brand name Alkim, the company sells sodium sulphate that is free of heavy elements including arsenic, lead, zinc, and chrome, which are found in sulphate made by chemical processes, as well as hazardous minerals.

CGC SAMCA – Under the brand name Minera de Santa Marta, the company sells sodium sulphate, which is an excellent filler and diluent because it is noncorrosive, neutral, and inexpensive.

Cooper Natural Resources Inc – Under the Cooper Natural Resources brand, the company sells sodium sulphate, which is used as a fining agent to eliminate microscopic air bubbles from molten glass.

Download Sample Report for highlights on product news and insights affecting the Sodium Sulfate Market.

Customize Your Report

Don’t miss out on the opportunity to speak to our analyst and know more insights about this market report. Our analysts can also help you customize this report according to your needs. Our analysts and industry experts will work directly with you to understand your requirements and provide you with customized data in a short amount of time.

Do reach out to our analysts for more customized reports as per your requirements. Speak to our Analyst now!

Related Reports:

Adhesives and Sealants Market by Type, Application, and Geography – Forecast and Analysis 2022-2026

|

Sodium Sulfate Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.02{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

|

Market growth 2022-2026 |

1427.55 th units |

|

Market structure |

Fragmented |

|

YoY growth ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48}) |

1.33 |

|

Regional analysis |

APAC, Europe, North America, MEA, and South America |

|

Performing market contribution |

APAC at 54{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

|

Key consumer countries |

China, US, Spain, Russian Federation, Japan, and Mexico |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Alkim Alkali Kimya, Bhagwati Chemicals, CGC SAMCA, Cooper Natural Resources Inc, Cordenka GmbH and Co. KG, Elementis Plc, Grupo Industrial Crimidesa SL, Krishna Chemicals, Lenzing AG, and Nippon Chemical Industrial Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Table of Contents

1. Executive Summary

1.1 Market Overview

Exhibit 01: Key Finding 1

Exhibit 02: Key Finding 1

Exhibit 03: Key Finding 2

Exhibit 04: Key Finding 3

Exhibit 05: Key Finding 4

Exhibit 06: Key Finding 5

Exhibit 07: Key Finding 5

Exhibit 08: Key Finding 6

2. Market Landscape

2.1 Market ecosystem

Exhibit 09: Parent market

Exhibit 10: Market characteristics

2.2 Value chain analysis

Exhibit 11: Value chain analysis: Commodity Chemicals

3. Market Sizing

3.1 Market segment analysis

Exhibit 12: Market segments

3.2 Market size 2021

3.3 Market definition

Exhibit 13: Offerings of vendors included in the market definition

3.4 Market outlook: Forecast for 2021 – 2026

Exhibit 14: Global – Market size and forecast 2021 – 2026 (thousand tons)

Exhibit 15: Global market: Year-over-year growth 2021 – 2026 ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48})

4. Five Forces Analysis

4.1 Five Forces Summary

Exhibit 16: Five forces analysis 2021 & 2026

4.2 Bargaining power of buyers

Exhibit 17: Bargaining power of buyers

4.3 Bargaining power of suppliers

Exhibit 18: Bargaining power of suppliers

4.4 Threat of new entrants

Exhibit 19: Threat of new entrants

4.5 Threat of substitutes

Exhibit 20: Threat of substitutes

4.6 Threat of rivalry

Exhibit 21: Threat of rivalry

4.7 Market condition

Exhibit 22: Market condition – Five forces 2021

5 Market Segmentation by Product

5.1 Market segments

Exhibit 23: Product – Market share 2021-2026 ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48})

5.2 Comparison by Product

Exhibit 24: Comparison by Product

5.3 Synthetic sodium sulfate – Market size and forecast 2021-2026

Exhibit 25: Synthetic sodium sulfate – Market size and forecast 2021-2026 (thousand tons)

Exhibit 26: Synthetic sodium sulfate – Year-over-year growth 2021-2026 ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48})

5.4 Natural sodium sulfate – Market size and forecast 2021-2026

Exhibit 27: Natural sodium sulfate – Market size and forecast 2021-2026 (thousand tons)

Exhibit 28: Natural sodium sulfate – Year-over-year growth 2021-2026 ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48})

5.5 Market opportunity by Product

Exhibit 29: Market opportunity by Product

6 Market Segmentation by Application

6.1 Market segments

Exhibit 30: Application – Market share 2021-2026 ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48})

6.2 Comparison by Application

Exhibit 31: Comparison by Application

6.3 Detergent – Market size and forecast 2021-2026

Exhibit 32: Detergent – Market size and forecast 2021-2026 (thousand tons)

Exhibit 33: Detergent – Year-over-year growth 2021-2026 ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48})

6.4 Glass – Market size and forecast 2021-2026

Exhibit 34: Glass – Market size and forecast 2021-2026 (thousand tons)

Exhibit 35: Glass – Year-over-year growth 2021-2026 ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48})

6.5 Pulp and paper – Market size and forecast 2021-2026

Exhibit 36: Pulp and paper – Market size and forecast 2021-2026 (thousand tons)

Exhibit 37: Pulp and paper – Year-over-year growth 2021-2026 ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48})

6.6 Others – Market size and forecast 2021-2026

Exhibit 38: Others – Market size and forecast 2021-2026 (thousand tons)

Exhibit 39: Others – Year-over-year growth 2021-2026 ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48})

6.7 Market opportunity by Application

Exhibit 40: Market opportunity by Application

7. Customer landscape

7.1 Overview

Technavio’s customer landscape matrix comparing Drivers or price sensitivity, Adoption lifecycle, importance in customer price basket, Adoption rate and Key purchase criteria

Exhibit 41: Customer landscape

8. Geographic Landscape

8.1 Geographic segmentation

Exhibit 42: Market share by geography 2021-2026 ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48})

8.2 Geographic comparison

Exhibit 43: Geographic comparison

8.3 APAC – Market size and forecast 2021-2026

Exhibit 44: APAC – Market size and forecast 2021-2026 (thousand tons)

Exhibit 45: APAC – Year-over-year growth 2021-2026 ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48})

8.4 Europe – Market size and forecast 2021-2026

Exhibit 46: Europe – Market size and forecast 2021-2026 (thousand tons)

Exhibit 47: Europe – Year-over-year growth 2021-2026 ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48})

8.5 North America – Market size and forecast 2021-2026

Exhibit 48: North America – Market size and forecast 2021-2026 (thousand tons)

Exhibit 49: North America – Year-over-year growth 2021-2026 ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48})

8.6 MEA – Market size and forecast 2021-2026

Exhibit 50: MEA – Market size and forecast 2021-2026 (thousand tons)

Exhibit 51: MEA – Year-over-year growth 2021-2026 ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48})

8.7 South America – Market size and forecast 2021-2026

Exhibit 52: South America – Market size and forecast 2021-2026 (thousand tons)

Exhibit 53: South America – Year-over-year growth 2021-2026 ({6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48})

8.8 Key leading countries

Exhibit 54: Key leading countries

8.9 Market opportunity by geography

Exhibit 55: Market opportunity by geography ($ billion)

9. Drivers, Challenges, and Trends

9.1 Market drivers

9.1.1 Growing demand for sodium sulfate in China

9.1.2 Sodium sulfate is recognized as safe for use in food packaging

9.1.3 Increasing demand for sodium sulfate in the glass manufacturing industry

9.2 Market challenges

9.2.1 Increasing substitute for sodium sulfate

9.2.2 Growing demand for liquid detergents

9.2.3 Side effects of sodium sulfate

Exhibit 56: Impact of drivers and challenges

9.3 Market trends

9.3.1 Growth in demand as a dyeing agent in the textile industry

9.3.2 Increase in zinc production

9.3.3 Rise in construction activities

10. Vendor Landscape

10.1 Overview

Exhibit 57: Vendor landscape

The potential for the disruption of the market landscape was moderate in 2020, and its threat is expected to remain unchanged by 2025.

10.2 Landscape disruption

Exhibit 58: Landscape disruption

Exhibit 59: Industry risks

11. Vendor Analysis

11.1 Vendors covered

Exhibit 60: Vendors covered

11.2 Market positioning of vendors

Exhibit 61: ?Market positioning of vendors?

11.3 Alkim Alkali Kimya

Exhibit 62: Alkim Alkali Kimya – Overview

Exhibit 63: Alkim Alkali Kimya – Business segments

Exhibit 64: Alkim Alkali Kimya – Key offerings

Exhibit 65: Alkim Alkali Kimya – Segment focus

11.4 Bhagwati Chemicals

Exhibit 66: Bhagwati Chemicals – Overview

Exhibit 67: Bhagwati Chemicals – Product and service

Exhibit 68: Bhagwati Chemicals – Key offerings

11.5 CGC SAMCA

Exhibit 69: CGC SAMCA – Overview

Exhibit 70: CGC SAMCA – Product and service

Exhibit 71: CGC SAMCA – Key offerings

11.6 Cooper Natural Resources Inc

Exhibit 72: Cooper Natural Resources Inc – Overview

Exhibit 73: Cooper Natural Resources Inc – Product and service

Exhibit 74: Cooper Natural Resources Inc – Key offerings

11.7 Cordenka GmbH and Co. KG

Exhibit 75: Cordenka GmbH and Co. KG – Overview

Exhibit 76: Cordenka GmbH and Co. KG – Product and service

Exhibit 77: Cordenka GmbH and Co. KG – Key offerings

11.8 Elementis Plc

Exhibit 78: Elementis Plc – Overview

Exhibit 79: Elementis Plc – Business segments

Exhibit 80: Elementis Plc – Key offerings

Exhibit 81: Elementis Plc – Segment focus

11.9 Grupo Industrial Crimidesa SL

Exhibit 82: Grupo Industrial Crimidesa SL – Overview

Exhibit 83: Grupo Industrial Crimidesa SL – Product and service

Exhibit 84: Grupo Industrial Crimidesa SL – Key offerings

11.10 Krishna Chemicals

Exhibit 85: Krishna Chemicals – Overview

Exhibit 86: Krishna Chemicals – Product and service

Exhibit 87: Krishna Chemicals – Key offerings

11.11 Lenzing AG

Exhibit 88: Lenzing AG – Overview

Exhibit 89: Lenzing AG – Business segments

Exhibit 90: Lenzing AG – Key offerings

11.12 Nippon Chemical Industrial Co. Ltd.

Exhibit 91: Nippon Chemical Industrial Co. Ltd. – Overview

Exhibit 92: Nippon Chemical Industrial Co. Ltd. – Product and service

Exhibit 93: Nippon Chemical Industrial Co. Ltd. – Key offerings

Exhibit 94: Nippon Chemical Industrial Co. Ltd. – Key customers

Exhibit 95: Nippon Chemical Industrial Co. Ltd. – Segment focus

12. Appendix

12.1 Scope of the report

12.1.1 Market definition

12.1.2 Objectives

12.1.3 Notes and Caveats

12.2 Currency conversion rates for US$

Exhibit 96: Currency conversion rates for US$

12.3 Research Methodology

Exhibit 97: Research Methodology

Exhibit 98: Validation techniques employed for market sizing

Exhibit 99: Information sources

12.4 List of abbreviations

Exhibit 100: List of abbreviations

About Us:

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com/

SOURCE Technavio