The CFO & Head of Investor Relations of Green Landscaping Group AB (publ) (STO:GREEN), Carl-Fredrik Meijer, Just Bought A Few More Shares

Even if it can be not a big acquire, we consider it was superior to see that Carl-Fredrik Meijer, the CFO & Head of Investor Relations of Green Landscaping Group AB (publ) (STO:Green) not too long ago shelled out kr80k to purchase stock, at kr62.64 per share. Nevertheless, it only enhanced their shareholding by a minuscule proportion, and it wasn’t a substantial purchase by absolute benefit, both.

See our most current investigation for Environmentally friendly Landscaping Team

The Past 12 Months Of Insider Transactions At Eco-friendly Landscaping Group

In the last twelve months, the biggest single sale by an insider was when the Chief Executive Officer, Johan Nordstrom, sold kr16m worth of shares at a selling price of kr80.90 per share. We frequently don’t like to see insider offering, but the decreased the sale value, the extra it problems us. The fantastic information is that this significant sale was at nicely previously mentioned present selling price of kr59.20. So it may not shed a lot gentle on insider self confidence at existing ranges.

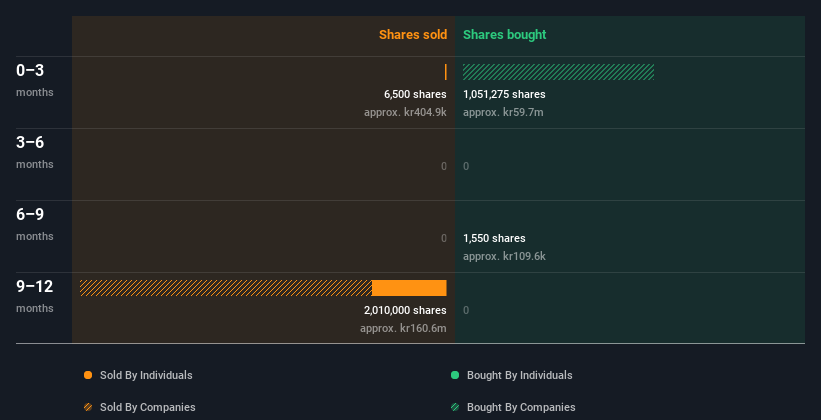

In full, Eco-friendly Landscaping Team insiders marketed additional than they bought around the last 12 months. The chart down below reveals insider transactions (by businesses and people) about the final year. If you click on on the chart, you can see all the unique transactions, which includes the share rate, specific, and the day!

I will like Environmentally friendly Landscaping Team superior if I see some huge insider purchases. Although we hold out, look at out this cost-free list of expanding providers with appreciable, recent, insider purchasing.

Insider Ownership

Numerous buyers like to examine how significantly of a company is owned by insiders. A large insider ownership normally makes corporation management more conscious of shareholder passions. It seems that Eco-friendly Landscaping Team insiders individual 14{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} of the enterprise, well worth about kr455m. We’ve unquestionably found higher concentrations of insider ownership in other places, but these holdings are sufficient to advise alignment involving insiders and the other shareholders.

What Might The Insider Transactions At Inexperienced Landscaping Team Tell Us?

Unfortunately, there has been more insider marketing of Inexperienced Landscaping Team inventory, than buying, in the previous three months. Irrespective of some insider buying, the more time phrase photo won’t make us experience substantially more optimistic. But because Eco-friendly Landscaping Group is worthwhile and rising, we’re not far too worried by this. The business offers superior insider possession, but we are a little hesitant, specified the heritage of share profits. So while it is valuable to know what insiders are accomplishing in terms of obtaining or advertising, it really is also valuable to know the threats that a distinct corporation is going through. To that finish, you ought to learn about the 2 warning signs we’ve spotted with Inexperienced Landscaping Team (like 1 which is a little bit concerning).

But note: Environmentally friendly Landscaping Team may not be the very best inventory to get. So choose a peek at this totally free record of exciting businesses with high ROE and low financial debt.

For the needs of this posting, insiders are those people folks who report their transactions to the appropriate regulatory overall body. We at present account for open up marketplace transactions and private inclinations, but not spinoff transactions.

Valuation is intricate, but we’re helping make it very simple.

Come across out no matter if Environmentally friendly Landscaping Team is perhaps over or undervalued by examining out our complete assessment, which includes truthful price estimates, risks and warnings, dividends, insider transactions and economic health.

Check out the Free Analysis

Have responses on this article? Involved about the information? Get in touch with us right. Alternatively, e mail editorial-workforce (at) simplywallst.com.

This post by Merely Wall St is normal in nature. We give commentary based on historical details and analyst forecasts only utilizing an impartial methodology and our content are not supposed to be monetary information. It does not constitute a recommendation to acquire or offer any inventory, and does not just take account of your targets, or your financial problem. We goal to deliver you lengthy-time period focused evaluation pushed by essential details. Notice that our examination may possibly not aspect in the newest selling price-sensitive firm bulletins or qualitative material. Only Wall St has no posture in any stocks described.