Understanding the super fund landscape

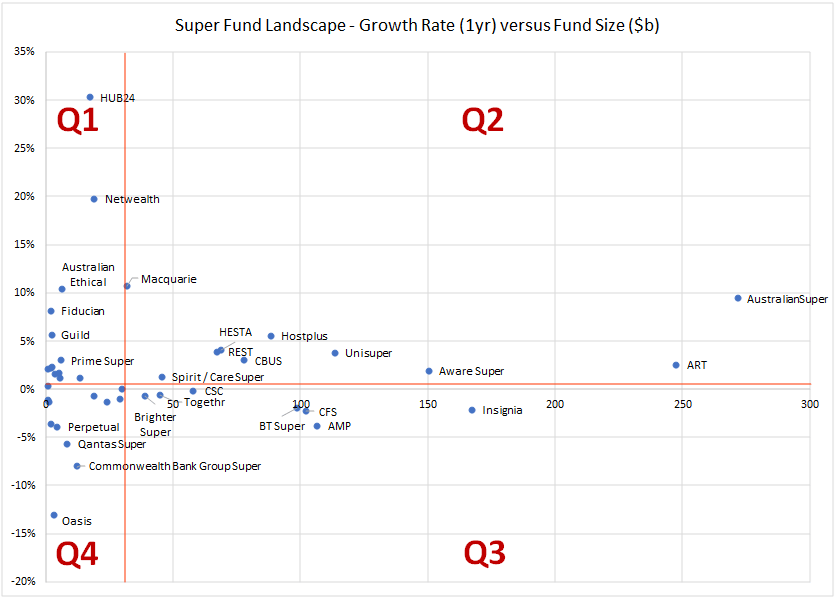

Combining size and inflow rates creates a much richer picture of the super fund landscape (for APRA regulated super funds). We are able to divide the universe into four quadrants based on these two dimensions. Some funds are in a strong position and the future is bright. For others there is uncertainty and work ahead.

Exploring the super fund landscape

We took the APRA fund level dataset (for FY2022) and, similarly to previous articles on size and inflow, we adjusted for the one-off impact of successor fund transfers, aggregated multiple product offerings under the same parent company, and accounted for announced merger intentions (but were unable to account for the BT asset transition into Mercer Super). Finally, we estimated assets for CSC based on assets managed rather than defined benefit liabilities.

We then created a plot of growth rates (annualised 1yr growth rate) against assets under management. Note that we removed small (sub $1b) corporate plans out of this analysis.

Some further explanation may help to understand the diagram. You will notice two red lines. The vertical line represents the $30b scale figure espoused by APRA. The horizontal line represents the 2.2{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} system level growth (net inflows) recorded in FY2022 (note that this figure ignores investment returns). These two lines create a natural four quadrant segmentation of the super fund industry which we explore in further detail. In the diagram above we don’t name every fund (as the picture would become too congested), but each fund’s situation is detailed in our exploration below.

Some further explanation may help to understand the diagram. You will notice two red lines. The vertical line represents the $30b scale figure espoused by APRA. The horizontal line represents the 2.2{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} system level growth (net inflows) recorded in FY2022 (note that this figure ignores investment returns). These two lines create a natural four quadrant segmentation of the super fund industry which we explore in further detail. In the diagram above we don’t name every fund (as the picture would become too congested), but each fund’s situation is detailed in our exploration below.

Quadrant 1 – Below scale but good growth

| AUM ($b) | Growth Rate (1yr) | |

| Netwealth | 19.2 | 19.7{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| HUB24 | 17.2 | 30.3{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Australian Ethical | 6.3 | 10.4{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Prime Super | 6.1 | 3.0{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| AMIST | 2.6 | 2.3{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Guild | 2.4 | 5.6{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Fiducian | 1.9 | 8.2{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| REI Super | 1.9 | 2.2{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

While below APRA’s scale figure, some of these funds (Netwealth and HUB24) will reach scale quickly if they maintain their high growth rates. It is important to acknowledge that scale is a complex issue, and we shouldn’t overly weigh on a single figure. For instance Netwealth, HUB24 and Australian Ethical all achieve business scale through other activities such as non-super product management. Highlights of the fastest growing funds are their successful targeting of specific segments, be it technologically advanced platform service offerings (Netwealth, HUB24 and Fiducian), ESG and sustainability thematic (Australian Ethical), and targeting a female demographic (Guild). The remaining funds on this list (Prime, AMIST and REI Super) benefitted from above-sector natural inflow rates.

Quadrant 2 – Good scale and good growth

| AUM ($b) | Growth Rate (1yr) | |

| AustralianSuper | 271.7 | 9.4{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| ART | 247.4 | 2.6{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Unisuper | 113.6 | 3.7{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Hostplus | 88.4 | 5.5{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| CBUS | 78.0 | 3.0{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| HESTA | 69.0 | 4.1{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| REST | 67.2 | 3.9{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Macquarie | 31.8 | 10.7{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

While all these funds are experiencing above-system growth levels, AustralianSuper and Macquarie are the standout case studies. It is a fascinating situation when the largest fund is also one of the fastest growers, benefitting from a strong natural inflow position and an entrenched leadership position in the competitive inflow marketplace. Macquarie, like Netwealth, HUB24 and Fiducian, appears to be performing strongly in the platform sector. The growth rate for the remaining seven funds, all not-for-profit, are largely driven by their above-system natural inflows (particularly strong in the cases of Hostplus, HESTA and REST). Unisuper performed strongly in competitive inflow while REST experiences sizable competitive outflows, a challenge for funds with a significant first employment membership.

Scale affords this sector a strong ongoing competitive offering, both from an investment and an operational fee perspective which should enhance their competitive opportunities.

Quadrant 3 – Good scale but sub-system growth

| AUM ($b) | Growth Rate (1yr) | |

| Insignia | 167.3 | -2.2{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Aware Super | 150.7 | 1.9{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| AMP | 106.4 | -3.8{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| CFS | 102.1 | -2.3{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| BT Super | 98.7 | -2.0{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| CSC | 57.9 | -0.2{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Spirit / Care Super | 45.5 | 1.3{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Togethr | 44.7 | -0.6{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Brighter Super | 38.8 | -0.7{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Vision / Active Super | 29.8 | 0.0{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Mercer Super | 29.3 | -1.0{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

There are two stories to explore here, one being big retail and the other being big profit-for-member funds.

Big retail funds (Insignia, AMP, CFS and BT Super) headlined the dollar outflow in our previous analysis (here) and their growth rates are well below system, but not catastrophic. The natural inflow situation for these funds is mixed (modestly positive for AMP and BT Super, flat for CFS, while Insignia experienced modest natural outflow). Where each of these groups is struggling is in competitive outflows (reasonable for BT, CFS and Insignia, but sizable for AMP). They face multiple challenges: not only the frequent anecdote about flows from the retail to the profit-for-member sector, but also competition from smaller for-profit competitors like Netwealth, HUB24 and Macquarie.

There is also a cohort of above-scale profit-for-member funds who experienced below sector growth. In some cases, Aware and the aggregated Spirit / Care Super, the degree of underperformance was very small. Most of these groups, the exceptions being Aware and Spirit / Care who were both stronger, experienced relatively modest natural inflows. Each of these groups, to different degrees, experienced competitive outflow. Of interest, if the proposed merger between Vision Super and Active Super did not proceed, both funds would be placed in Quadrant 4 of our analysis.

Scale affords the funding to develop strategies and make business investments required to develop a more effective growth strategy. The funds in quadrant three have sufficient scale to be able to maintain a competitive offering.

Quadrant 4 – Below scale and sub-system growth

| AUM ($b) | Growth Rate (1yr) | |

| Telstra Super | 24.0 | -1.4{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Mine / TWU Super | 19.0 | -0.7{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| NGS Super | 13.4 | 1.1{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Commonwealth Bank Group Super | 12.4 | -8.0{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Qantas Super | 8.5 | -5.7{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| BUSSQ | 5.6 | 1.1{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| legalsuper | 5.1 | 1.6{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Perpetual | 4.5 | -3.9{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| First Super | 3.7 | 1.6{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Oasis | 3.3 | -13.1{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| ClearView | 2.1 | -3.7{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| Bendigo Super | 1.5 | -1.3{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| MIESF | 1.0 | -1.1{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| NESS Super | 1.0 | 2.1{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

| FES Super | 0.8 | 0.3{6d6906d986cb38e604952ede6d65f3d49470e23f1a526661621333fa74363c48} |

There is a large dispersion in situation amongst funds in this quadrant. Corporate funds TelstraSuper, Commonwealth Bank Group Super and Qantas Super each experienced flat or modest natural inflow and suffered negative competitive flows (Commonwealth particularly) in a marketplace where they are less active in seeking new members. TelstraSuper’s size is much closer to APRA’s scale figure.

The proposed Mine / TWU merger still doesn’t reach APRA’s scale figure while creating a merged entity in outflow. Other profit-for-member funds are small and experiencing a growth rate marginally below industry average (NGS, BUSSQ, legalsuper, First Super and NESS). These groups all experienced solid natural inflows but were impacted by negative competitive flows.

From a sustainability perspective, it is the funds in quadrant four which are likely to face most scrutiny from APRA.

David Bell is executive director at The Conexus Institute.